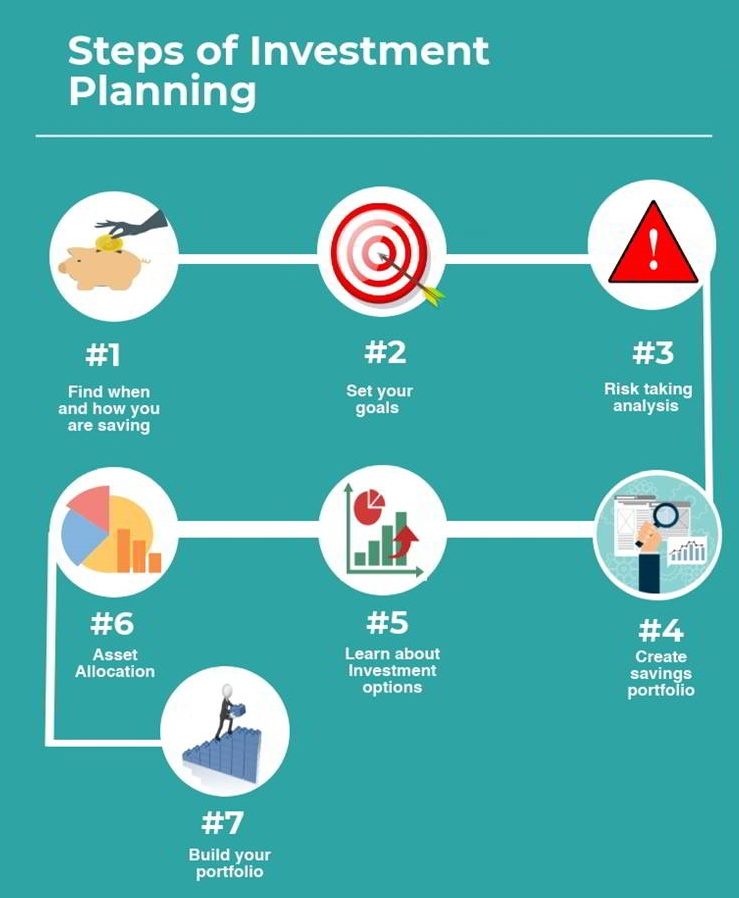

Investment and Goal’s Planning

Investment Portfolio Advisory

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse dignissim, mi ullamcorper gravida euismod, dui neque congue magna, non tristique velit nibh pellentesque enim. Aenean pellentesque nisl ac mi dapibus mattis. Phasellus facilisis sit amet purus nec tempor. Quisque convallis turpis ut orci euismod, quis imperdiet urna pulvinar. Proin facilisis vulputate accumsan. Aliquam porttitor vitae tortor at suscipit. Cras dignissim dictum vulputate. Suspendisse potenti. Fusce est sem, suscipit ac nibh a, maximus tempus turpis. In commodo leo et purus tincidunt, a sollicitudin eros feugiat. Ut ac neque ac lorem sollicitudin feugiat. Donec metus turpis, sagittis eu nunc nec, euismod elementum ligula. Duis egestas felis ligula, et mollis libero varius quis. Aenean lorem lacus, molestie vel elit ut, molestie accumsan dolor. Aenean semper vitae dui at finibus.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse dignissim, mi ullamcorper gravida euismod, dui neque congue magna, non tristique velit nibh pellentesque enim. Aenean pellentesque nisl ac mi dapibus mattis. Phasellus facilisis sit amet purus nec tempor. Quisque convallis turpis ut orci euismod, quis imperdiet urna pulvinar. Proin facilisis vulputate accumsan. Aliquam porttitor vitae tortor at suscipit. Cras dignissim dictum vulputate. Suspendisse potenti. Fusce est sem, suscipit ac nibh a, maximus tempus turpis. In commodo leo et purus tincidunt, a sollicitudin eros feugiat. Ut ac neque ac lorem sollicitudin feugiat. Donec metus turpis, sagittis eu nunc nec, euismod elementum ligula. Duis egestas felis ligula, et mollis libero varius quis. Aenean lorem lacus, molestie vel elit ut, molestie accumsan dolor. Aenean semper vitae dui at finibus.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse dignissim, mi ullamcorper gravida euismod, dui neque congue magna, non tristique velit nibh pellentesque enim. Aenean pellentesque nisl ac mi dapibus mattis. Phasellus facilisis sit amet purus nec tempor. Quisque convallis turpis ut orci euismod, quis imperdiet urna pulvinar. Proin facilisis vulputate accumsan. Aliquam porttitor vitae tortor at suscipit. Cras dignissim dictum vulputate. Suspendisse potenti. Fusce est sem, suscipit ac nibh a, maximus tempus turpis. In commodo leo et purus tincidunt, a sollicitudin eros feugiat. Ut ac neque ac lorem sollicitudin feugiat. Donec metus turpis, sagittis eu nunc nec, euismod elementum ligula. Duis egestas felis ligula, et mollis libero varius quis. Aenean lorem lacus, molestie vel elit ut, molestie accumsan dolor. Aenean semper vitae dui at finibus.

Savings/Investment Options

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse dignissim, mi ullamcorper gravida euismod, dui neque congue magna, non tristique velit nibh pellentesque enim. Aenean pellentesque nisl ac mi dapibus mattis. Phasellus facilisis sit amet purus nec tempor. Quisque convallis turpis ut orci euismod, quis

Following are some investment schemes that can meet your future needs:

Fixed Deposits

This is a safe option where in a fixed sum of money is invested for a particular period that helps one to get interest at a fixed rate of return.

Fixed Deposits

Public Provident Fund

PPF is a tax free long term non-taxable government investment scheme in India which is invested for a term of 15 years.

Public Provident Fund

National Savings Certificates

NSC is a popular government backed saving scheme which is done for 5 years from any post office. Minimum investment for this scheme is Rs. 500.

National Savings Certificates

Mutual Funds

Mutual fund is a good option to invest for benefits in equities and debt fund. Mutual fund is better than directly investing in stock trading.

Mutual Funds

Equity Linked Saving Schemes

It is a mutual fund with tax benefits. In this one can avail of tax deduction upto Rs. 150000/- under section 80C with a lock in period of 3 years.

Equity Linked Saving Schemes

Why Investment Planning

Save for Emergency

Investment Planning helps you to increase your bank money which can be used for an emergency period. You don’t have to borrow money from anyone to pay your medical bills.

Meet Financial Goals

You can set your financial target like plan a holiday, buy a luxury item or target for retirement money.

Increase your Wealth

To become rich saving money is not sufficient. You need to invest smartly to get benefits of compounding.

Tax Benefits

You need to find the right equity linked saving plans to invest in equity mutual funds so that you can get tax benefits on the investments.

Get In Touch

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

H.o.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse dignissim, mi ullamcorper gravida euismod,

branch address

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse dignissim, mi ullamcorper gravida euismod, dui neque congue magna,

Email: sales@eiss.co.in